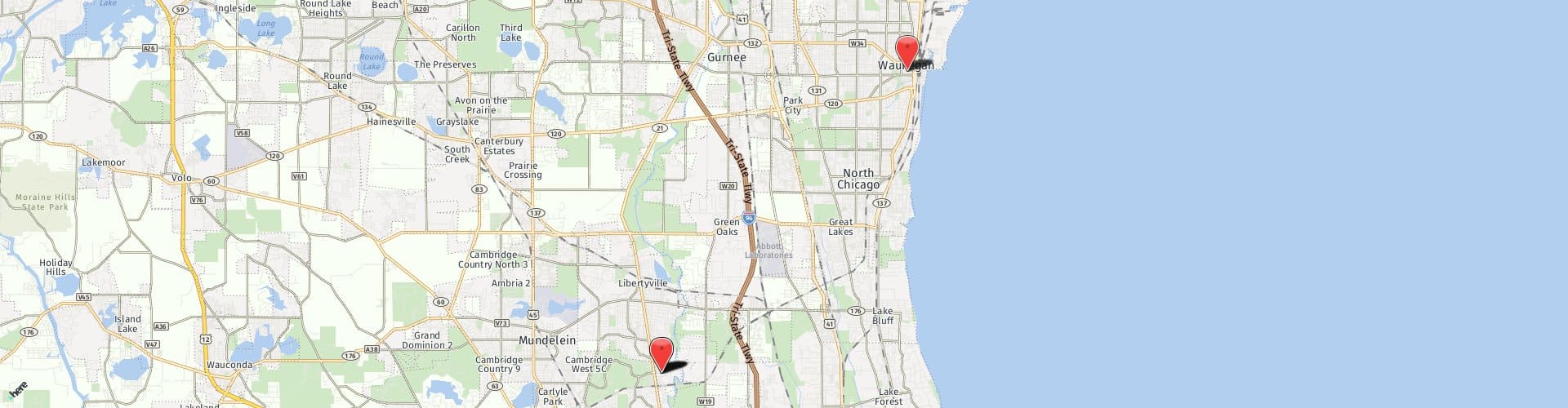

Serving Waukegan, Libertyville, Lake County, Gurnee & nearby areas of Illinois

Posted: July 12, 2019

For many people, the answer is yes. A living trust is a device that can help your heirs avoid probate court after you pass away and make transition of ownership of your assets relatively easy. We will review with you all of your significant assets and will advise you if a trust makes sense for your situation. Quite often, we recommend a living trust for people who own their own home and/or other real estate. Once your will, trust and other estate planning documents are executed, we will assist with transferring title to your real estate and your other assets in to the trust. When you pass away, the title to the real estate and other assets remains in the trust but ontrol over the property goes to the successor trustee you designate. Upon the sale of the property, the proceeds will be transferred however you designate. The trust terms cannot change after you pass away.

Another advantage to a trust is privacy. Illinois law requires that the original will of a deceased person be filed with the Clerk of the Circuit Court in the county where the person resided within 30 days of their death. A filed will is a public record and anyone can find out to whom you left your assets. This could subject your heirs to harassment and/or fraud attempts as predators seek to take advantage of their new found wealth.

Finally, a trust can be crafted to address situations that you may not have foreseen, such as a child passing away before you do or your family dying together in a tragic accident. Living trusts are usually revocable which means you can cancel it or modify it at any time as your life circumstances change.

If you need to create or update an estate plan and are considering a trust, feel free to contact us at (847) 599-9101 to see how we can assist you.