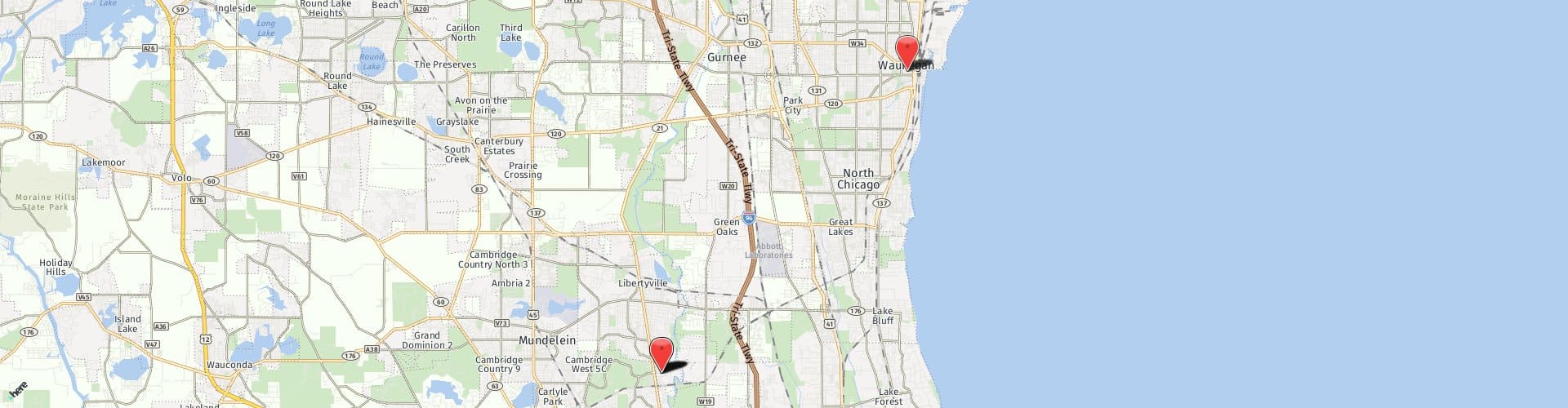

Serving Waukegan, Libertyville, Lake County, Gurnee & nearby areas of Illinois

Posted: May 4, 2012

With the exception of Cook County, most of the counties in the Chicago area mailed out the 2011 property tax bills this week. Many of our clients contact us at this time of year with sticker shock and wondering if there is anything they can do about the increase in their bill. In the vast majority of cases, the answer is no. In Lake County, assessment notices are mailed out in the fall and you have a limited window of opportunity to contest the amount of the assessment. It is too late now to contest your assessment if you did not do it in the fall. Even if your assessment is fair, your tax bill could increase significantly. An assessment is used only to apportion your share of the taxes levied by the various taxing bodies (school districts, municipalities, county, etc.) among you and your neighbors. If one or more of the taxing bodies in your area chose to raise their levy for this year and thereby increase your tax rate, your bill can increase even if the assessed value of your home went down We frequently explain to people that the benefit of a reduced assessment on their home has limitations. The only way to truly reduce the amount of your tax bill is to convince the taxing districts to spend less money. This can only be done through voting for the right representatives and appearing at public budget meetings. The bottom line is that most people are seeing their property tax bills stay level or increase even though their property value has gone down significantly in this market. The taxing system is deliberately complicated so that it is very hard to reduce what you owe and even harder to force the government bodies to take less. As for the bill you got this week, we feel your pain.